Manufacturers and Raw Material Suppliers Refocus for Ukraine War

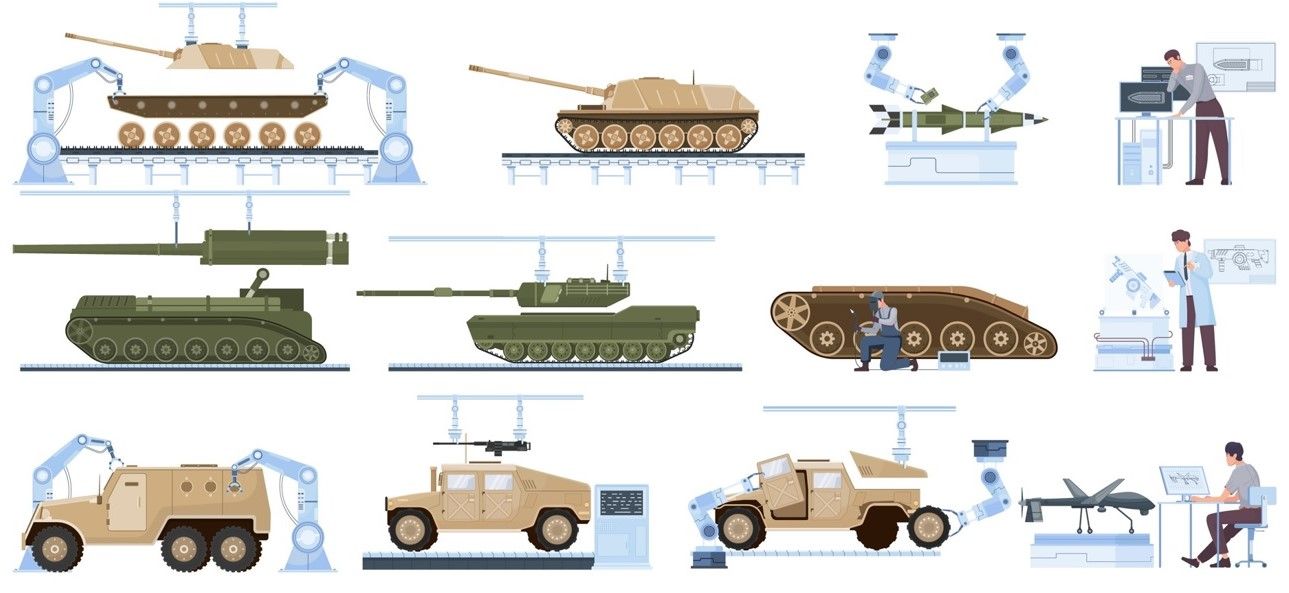

The speed of raw material procurement and production is now a top priority for Europe’s arms manufacturers.

Many years from now, when peace has finally returned to Ukraine, historians shall look back on its war with Russia as a defining period of our times. Much as we look back on the American wars in Iraq or Vietnam, in the future people will remember the news stories filled with tank explosions and muddy trench fighting.

Central to this war of attrition has been the ability to bring weapons and ammunition to the frontline. Central to that has been the ability of nations to produce and deliver those armaments.

For defence manufacturers in Europe this has meant a refocus on obtaining the raw materials they need and quickly turning them into what the soldiers need.

“The key factor now tends to be speed,” reports the industry journal Defense News. Adding that, “Germany’s high-tech defense firms are adapting their business practices amid the war in Ukraine. Replacing the sector’s boutique approach with a greater focus on mass production. How soon systems can be delivered and combat-ready trumps clients’ requests for custom tailoring.”

“We have seen a fundamental change in our production philosophy,” notes Lothar Belz, a spokesperson for German sensor manufacturer Hensoldt.

This is a direct consequence of the war in Ukraine driving up demand as countries scramble to boost their national defence systems while still sending supplies to Kyiv. The result is a boost in the company’s large radar system sales from five per year to fifteen, with Belz predicting further increases to come (over half of Hensoldt's radar output this year is going to Ukraine).

Other defence manufacturers are also seeing a surge in sales and reduced customer expectations over details as time demands take priority.

“We definitely had orders where the customer said: ‘At the end of the day, we don’t care about the exact colour scheme that much,’” notes Pitt Marx, a spokesperson at defence Thales Germany. A similar situation can be seen at Hensoldt, where radar orders are now rushed out within a year of contract signing - a considerably faster rate than before Russia’s invasion.

The money for this surge in defence procurement has come from countries like Germany and Spain pledging to bump their defence budgets above the 2% of GDP expected from NATO members. This is in addition to the recent €100 billion cash boost for the German armed forces is a sign of what Chancellor Scholz has called the ‘Zeitenwende’ - referring to the turning-point in Germany’s military history as the nation re-arms itself in response to Putin’s aggression. The end result of this defence spending is “the most far-reaching change in German security policy since the Bundeswehr was founded in 1955.”

All of which is happening on top of the still ongoing supply chain disruptions caused by the pandemic.

For defence contractor Rohde & Schwarz this has meant investing in storage space and a refocus on securing its own supply chain. By maintaining a stock of vital components and feedstocks the firm was able to sustain manufacturing goals, even during the height of the COVID pandemic.

As a result, the company is more resilient to trade disruptions, such as the sanctions against Russia, while still keeping production in-house. As spokesperson Dennis-Peter Merklinghaus notes, “We can build everything from the smallest chips to ordinary server racks ourselves and do so within Germany.”

Belz also underlined the significance of Hensoldt’s supply chains which has increased its spending in logistics by constructing a new distribution centre and warehouse. In the past, the corporation would have ordered components as needed to meet contracts, but it now keeps supplies of essential parts on hand. To aid this move Hensoldt acquired ESG, a logistics and electronics company, at the beginning of December.

Across industry, it now also widely accepted that buyers of weapons systems and ammunition have to be ‘more pragmatic,’ a euphemism for lowering standards in the hope of a speedier delivery.

“The greater need for speed may also require customers to recalibrate their expectations,” observes Defense News. “In the past, it was common practice for government buyers to provide hundreds of pages and thousands of bullet points of individualized wishes for a contract, and even to change the requirements while production was already running.”

Things are clearly changing in the defence sector. As Belz concludes, “There is a fundamental difference in whether you are ordering something to keep an eye on your border, or whether you’re deploying it right into an active warzone.”

You may also like to read: EU Arms Industry Fails to Meet Ukrainian Munitions’ Pledge or Supply Chain Issues Slow F-35 Production.