Germany & EU Strengthen Arms Collaboration for Ukraine

Germany takes the lead in Europe in military aid for Ukraine while the EU boosts its defence strategy and procurement systems.

Germany has shifted its arms export policy to become one of the lead exporters to Ukraine. The latest data from the German government showing that the country authorized the sale of almost €4.88 billion worth of defence materiel during the first six months of 2024. A total which is more than double the arms exports to Kyiv during the whole of 2023.

The change in policy is even more astonishing given that when the German Chancellor, Olaf Scholz, took office in 2021, his centre-left coalition had won the election based on a campaign promise to further restrict oversees arms sales.

However, the Russian invasion has led to what Scholz famously called a ‘Zeitenwende’ (an historic turning point) which has seen total arms exports from Germany boosted to more than €7.5 billion in just H1 2024, 65% of which has been sent to Ukraine. This has made the country the second largest contributor in military aid to Kyiv’s defence, with only the US providing more.

The news of Germany’s switch to major arms exporter has come at a time of significant change in European defence markets. Most notable has been the move towards greater collaboration between EU member states, as the threat of Russian aggression has shown the need to work together for stronger defence while also improving procurement efficiency.

This was a key point highlighted by the EU’s the chief Executive of the European Defence Agency (EDA), Jiří Šedivý, when he explained how the appetite for cooperation among EU member states had, “… been accelerated and boosted [by the war].” Noting that, “We see it in in practice in a lot of activities, aiming first of all at supporting Ukraine, but also at replenishing, reinforcing their own national stocks.”

Critics have stated that the EU has consistently been slow to react as a military force due to its disjointed structure and unwillingness to become involved in overseas conflicts. However, there are clear signs that the fighting in Ukraine is solidifying the EU’s military forces, with the EDA playing a key role in this shift.

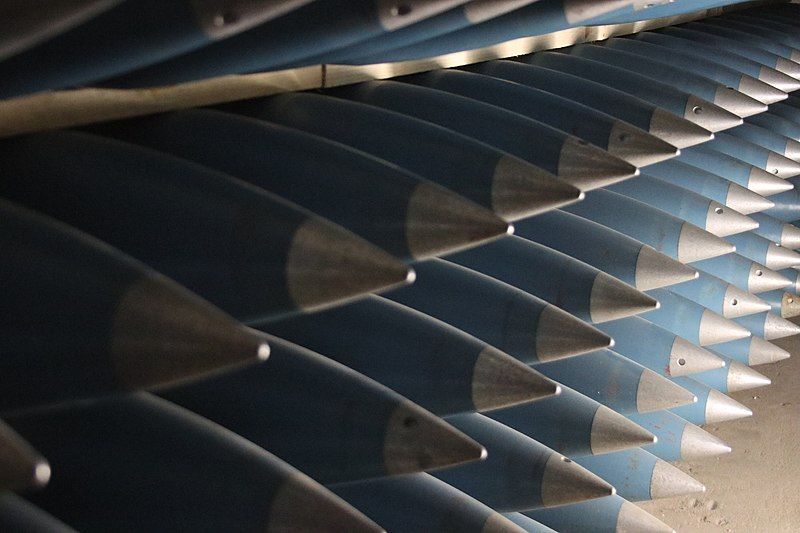

As the arms industry journal Defence News reports, “the agency has slowly moved from a facilitator of collaboration among member states, with sometimes vague outcomes, to a more hands-on broker of critical military equipment urgently needed in Ukraine.” For example, the agency has established a ‘menu’ for 155-millimeter artillery shell purchases by individual EU member states, “as well increasing cooperation between the EU and NATO.”

On this point, Šedivý, who was a former Czech Defence Minister, expanded to explain how the coordination operates, explaining, “Our framework contracts were based on an initial request for information and still have the potential to contract for up to €1 billion worth of 155mm ammunition. And we’re not talking about buying off-the-shelf, we are talking about production. What we contract today would be delivered in 12 to 24 months.”

When asked how much a 155mm round costs, he is open about the challenges that buyers face at a time when such a vast attritional war is ongoing. Stating that, “There is [price] fluctuation. But it’s definitely much more than before the war started. There isn’t a unit price. It could be from €4,000 to €10,000.”

When asked what a fair price is, he diplomatically replies that, “There is nothing like fair price, there is a market price.”

As a result of these market forces, the EU has been trying to better coordinate member states when purchasing arms for both Ukraine and national stockpiles.

“What we do in terms of 155-millimetre ammunition; 60 framework contracts, 10 member states actually contracting through us,” says Šedivý. “Our estimate is that the volume of orders is now about €350 million, which is not bad given the current, worldwide appetite for 155mm ammunition. But at the same time, we still have a lot of spare capacities within the framework contracts that we have concluded with industry.”

Another side of the EU’s work has been to encourage members states to contribute to the Ukrainian war effort through incentives. Which, according to Šedivý includes, “Everything from the European Defence Fund, European Peace Facility reimbursement for equipment donated to UA, to the yet-to-be-established European Defence Industrial Program, et cetera. The incentive, in the end, is money. But it’s also economies of scale coming from getting together on collaborative programs.”

A further part of EU coordination, alongside economic incentives and coordinated procurement, has been the necessity to simplify what arms and weapons are sent to the front. With so many nations contributing, it has become important that the ammunition sent is suitable for the guns there.

Most countries are already semi-aligned to common calibres established as part of NATO, but there is still work to be done in ensuring that non-NATO Ukrainian soldiers are trained in the weapons that are sent, or that ammunition is compatible with the possibly Soviet-era guns being used.

“What is happening in Ukraine in terms of using a plethora of various systems is unprecedented,” notes Šedivý. “And now I’m speaking about all the systems, not only artillery. So, this is something which has been addressed already, both in NATO and in our standardization committee, how to really accelerate the standardization leading to interchangeable commonality. This is something that we should really take seriously.”

It is here that he believes that Russia, fighting as one nation, holds an advantage over the NATO/EU/Ukrainian supply chain. With so many militaries combined it is not possible to establish a ‘one-size-fits-all’ 155mm artillery round.

As Šedivýexplains, “Given the mostly private ownership, you can’t force them. It might be easier for companies where states are majority owners. We see it in Russia, how easy it was for them to swap into the war economy mode. But here, we must incentivize with funds.”

Clearly there are issues still at hand. Prices are still high, as the war itself had an impact on the prices of fuel, metals, rare earth elements, electrical components, labour, and logistics. However, considering how disjointed the arms supply chain was when the Russian invasion began, the procurement system and the European industrial defence system has come a long, long way.

Prior to the war, Putin gambled on a lacklustre response from the West - instead, his plan has backfired. Sweden and Finland have since joined NATO, there is a strengthened political determination to keep Ukraine independent with an invitation to join both NATO and the EU when the war is over, and the EU now has a far more coordinated defence industry, more ready to work as one against aggression whenever it next occurs.

As Šedivý concludes, “With those incentives for joint procurement, we see now a change.”

You may also enjoy: Nimble Artillery – A Response to the Drone Threat or Western Shell Manufacturers Step into Top Gear - Again

Photo credit: Wikimedia, Flickr, Wikimedia, Flickr, & Wikimedia